"This is not a gold pumping blog"

He's right, it most certainly is not. Many other things get pumped, but definitely not gold, (coincidentally?) the undisputed best investment of the last decade. In our experience just not recommending something doesn't usually align with such hostility, there's usually a deeper reason, so we thought we'd dig back and try and establish a bit more background to the story, and BINGO.

Its because he called it wrong, through not understanding the basics, at the beginning of the multi-decade run, and has been on the outside looking in ever since.

23rd Feb 2003 The Contact Newspaper - Article reproduced below so that we can add comments, Turner's original in, er.. (gold ; )

Fear Factor's Golden Side

"Some of the most content investors these days are those who plowed money into precious metals mutual funds, and last year saw a 30 per cent return while the stock market sank by 12 per cent. The spot price of gold neared the $390-an ounce mark (in U.S. dollars, of course) recently, which was the best performance in six years. "

"Why is gold on a roll, after being in a bear market for the last 20 years? "We are certain he has as little idea why, now, as then. The bull fledgling market powered up as real interest rates went negative in 2002 (documented here) and further accelerated as smart money realized the path to war always involves deficits and dollar debasement, hence gold's response.

"It seems to me there is but one reason: because American has been under attack.Er, no it didn't (2003 article)

The run-up in gold started with Nine Eleven, and it has carried through the war on terrorism, the hunt for Osama bin Laden and now the impending conflict in Iraq.

Provocatively the bull market in gold launched two years ago, well before the heated debate running up to the Iraq war and even before the 9/11 terrorist attacks in the United States. If gold had only been rising for a few months the Iraq war thesis would probably have some merit, but with gold galloping higher for a couple years now the Iraq war obviously hasn’t been the prime driver of the entire new gold bull.

The yellow metal has gained strength as the American currency stumbled and the U.S. economy struggles to recover after the loss of over one million jobs following September the 11th, 2001."Uh, huh. so people are all so afraid of OBL for America they are rushing out to buy gold are they? : )

"Because gold is seen as an alternative to folding money and a safe haven in times of trouble, there is normally an inverse relationship between the value of the American dollar and bullion. Right now geopolitical tensions are top of mind for most investors, and those who fear things will get worse before they get better continue to pile into gold".Or, those who understood that the American war machine is an integral part of government understood the long term implications on the US, and it's currency. Maybe the smart money knew of the US plan for a decade of middle-east wars?

"And there are some smart people included here, by the way, like Donald Coxe of Harris Investments. That guru is now calling for a 10-yearlong (at least) bull market for gold, and suggests that all of us should have 10 per cent or so of our RRSP money in the metal"

Don Coxe was smart (and 100% right) then, and nothing has changed, here is a recent MP3 we advise listening to. Almost exactly at the end of that 10 year period we are only part way through this bull market and gold has appreciated 425% (Jan 2013) having been up to 485%.

Turner watched it go without him & missed out on an average 42.5% per annum for ten years & counting...

"So, should you buy gold? I don’t think there is a simple answer to that question."His answer is not simple, because he needed you to buy mutual funds though home equity loans instead

"Gold is a speculative investment, because the only return you will get is if it rises in value. In other words, there is no interest or dividends to collect - all you can hope for is a capital gain. At the same time, gold has few industrial uses that amount to much demand for production. Yes, gold continues to be used to manufacture jewelry, but that is not a burgeoning industry. In other words, the demand for bullion is coming from people who think it will rise in value as the world becomes an even more dangerous place. And that could well happen. The next few weeks will give a good indication. "Deeply flawed understanding, it is nothing to do with "people thinking the world is more dangerous"

"On the other hand, there are a number of significant factors working against a further run-up in gold prices. The most significant is the fact inflation has largely been defeated, and there are even deflationary tendancies all around us."Ah, the ever-present "deflation threat" in a negative real interest rates and cheap money world,. Anything sound familiar here yet at all? : )

"It was inflation alone that fuelled gold’s greatest increase two decades ago when the metal soared to more than $800 an ounce U.S. If you remember those days, then you will recall that cash was trash.

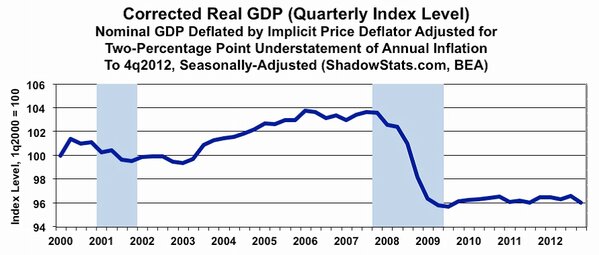

With inflation running at 12 per cent or 14 per cent a year, it made sense to buy physical assets, like gold or real estate, that would not lose value as cash was. "As you can see from the

"These days core inflation is completely under control. Interest rates have dropped to near a 40-year low, bonds have soared in value and have just one way to go, and the stock markets have been in a three-year struggle to find bottom. "And this is where the fundamental misunderstanding in Turner's financial world lies, unless by "under control", he means "systematically engineered out of the figures". The chart below shows the rate of inflation

- As it used to be calculated

- At the kind of levels that would explain the behavior of the asset prices above.

Courtesy Shadowstats - inflation calculated the old way

We can tell you categorically, that the smart money who have been the recipients of this ongoing wealth transfer for the last decade, were not buying through "fear"; they were buying through knowledge of history and understanding the true causes, and this is also why to this day Turner fears that, which he does not understand.

If the world was a normal place, then gold bullion would continue to be in the same slump it endured for years and years. But, things are not normal. Americans are stocking up on batteries, water, plastic sheeting and duct tape. It is this fear that is behind the rise in gold bullion. And investing by fear usually ends as badly as investing by greed.

These days he maintains that: (Source)

Read my books. I have consistently recommended a gold position – ideally of about 5% with consistent profit-taking to maintain that position. Had you followed this, you would been a happy person. I am. — GarthHowever this is not apparent in any single article he has ever put onto the internet, that we can find, and his own weighting is also 1% according to the quote here

Garth Turner’s Investment Television airs Sundays on Global.

Internet, garth.ca - Editors's Note: we are sure this show was pure gold

No comments:

Post a Comment